Redwood Grove’s Net Zero Portfolio

With approximately 40% of global greenhouse gas emissions stemming from publicly traded firms and the surge in corporate Net Zero commitments, Redwood Grove discusses how we separate the signal from the noise. As a member of the Net Zero Asset Managers Alliance, we divide companies across three categories—those aligned with Net Zero by 2050, those with emission reduction targets, and those lacking meaningful reduction goals. Our analysis process goes further with comprehensive company specific climate research that goes beyond mere pledges, providing a nuanced, holistic view of which companies are well positioned for a low carbon transition.

Climate Change and Public Equity Investing

This Redwood Grove update highlights the importance of incorporating climate science into public equity investing, contrary to the belief that public companies are too big and diverse to have real climate impact. Given the critical role these companies play in transitioning to a low carbon economy, we discuss the investment opportunities presented, highlighting the energy consulting firm Willdan as an attractively valued company responding to increased demand for energy efficiency programs.

Ted Roosevelt V discusses climate investing on Experts Only Podcast

Listen to Jon Powers in conversation with Ted Roosevelt, co-Founder of Redwood Grove Capital, as they discuss the evolution of sustainability and climate investing, the need for standardized, audited metrics in ESG investing, and the opportunities for investors when it comes to climate change mitigation and adaptation.

Adaptation and Migration

In this quarterly update, we share the challenges in finding attractively valued clean energy companies and highlight investment opportunities in Array Technologies and Flextronics. We look at the growing attention around Net Zero commitments as a useful framework and starting point, while emphasizing the need for concrete plans in approaching these goals for a meaningful transition to a low-carbon economy.

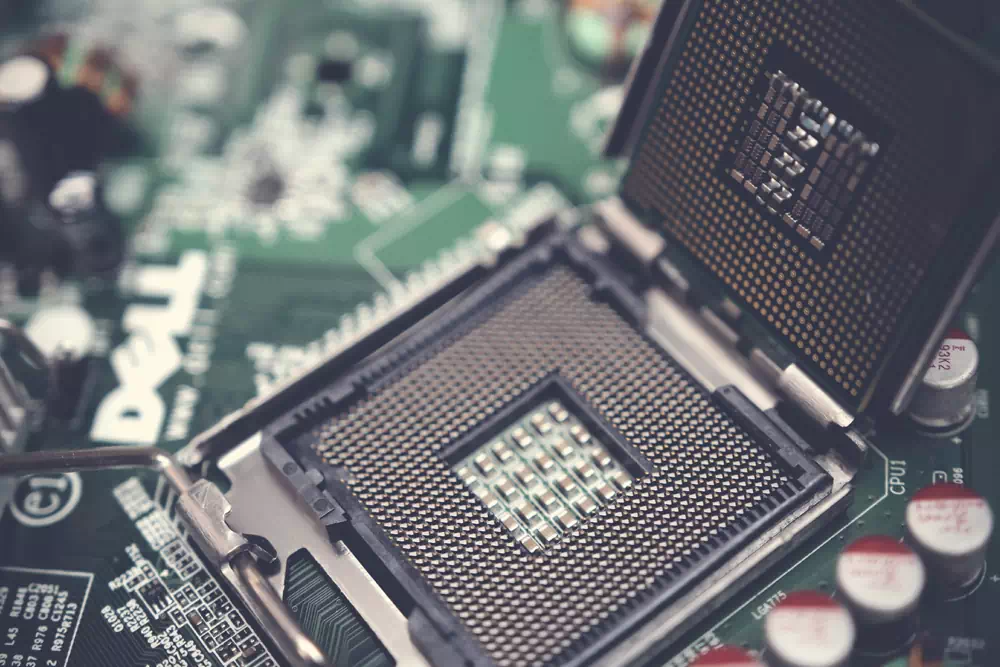

Microchip Shortage

Redwood Grove delves into the climate change risks affecting semiconductor manufacturing, exemplified by the recent chip shortage brought on by Taiwan’s drought. We discuss some challenges facing ESG investing, and spotlight Alphabet’s (GOOG) efforts to achieve 100% renewable energy usage as an example of how public companies can move the needle in carbon reduction.

Clean Tech Rally

Redwood Grove Capital’s latest letter explores the surge in clean energy stocks in 2020, driven by optimistic expectations for a more favorable regulatory environment. We discuss the complexities of transitioning to a low-carbon economy, using railroads as an example of hurdles facing traditional industries, and highlighting Intel as a secondary beneficiary amid the global shift towards electric vehicles and interconnected devices.

Regulatory Change and Climate Investing

Redwood Grove examines the evolving landscape of climate-focused investing and potential regulatory impacts. We analyze the Department of Labor proposal’s impact on ESG considerations for pension plans and highlight the U.S. Commodity Futures Trading Commission’s report sounding alarms around climate’s systematic and economic risks to the financial system.

Economic Impacts of Climate Change

In this letter, we revisit the core thesis behind Redwood Grove’s strategy, sharing our research process of aligning fundamental and climate analyses to identify companies that can perform well in up and down cycles. We share why we joined investors managing close to a $1 trillion of assets to sign the Ceres letter, calling on the Federal Reserve to more actively incorporate climate change into its mandate of maintaining US market stability.

Ignoring Climate Change Risks Market Chaos

Woodwell Climate Research Center Executive Director Phil Duffy and Ted Roosevelt talk about the cost of ignoring scientific forecasts. A global pandemic like Covid-19 had long been forecasted by scientists, however the risks were largely ignored by the markets until the pandemic was on its doorstep. Climate change represents a similar kind of risk but on a longer and more expensive time scale. Unlike Covid-19, there is no vaccine for greenhouse gases.