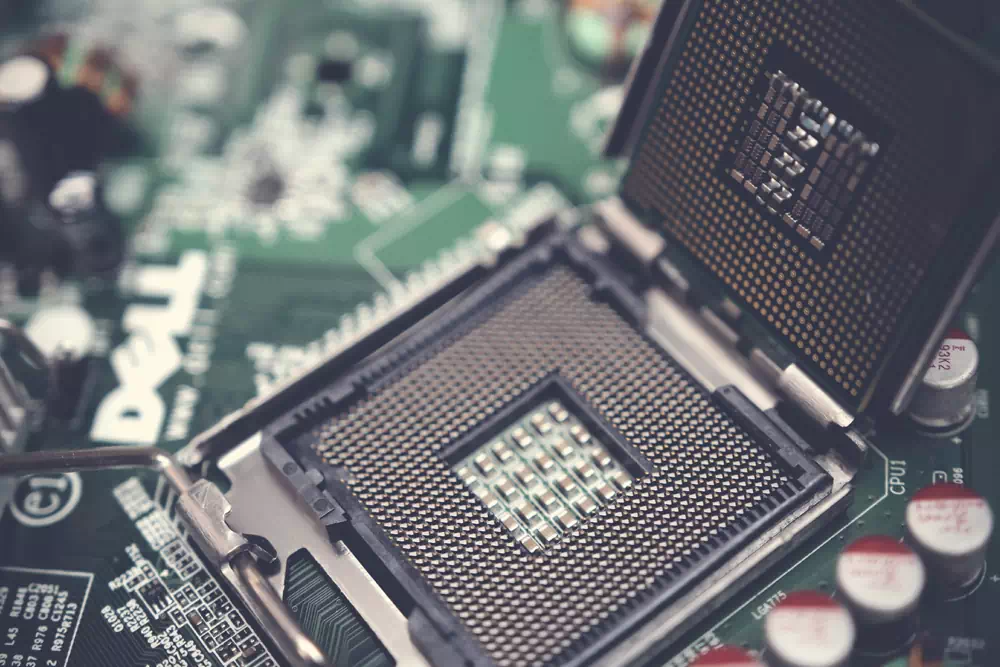

Microchip Shortage

Redwood Grove delves into the climate change risks affecting semiconductor manufacturing, exemplified by the recent chip shortage brought on by Taiwan’s drought. We discuss some challenges facing ESG investing, and spotlight Alphabet’s (GOOG) efforts to achieve 100% renewable energy usage as an example of how public companies can move the needle in carbon reduction.

Clean Tech Rally

Redwood Grove Capital’s latest letter explores the surge in clean energy stocks in 2020, driven by optimistic expectations for a more favorable regulatory environment. We discuss the complexities of transitioning to a low-carbon economy, using railroads as an example of hurdles facing traditional industries, and highlighting Intel as a secondary beneficiary amid the global shift towards electric vehicles and interconnected devices.

Regulatory Change and Climate Investing

Redwood Grove examines the evolving landscape of climate-focused investing and potential regulatory impacts. We analyze the Department of Labor proposal’s impact on ESG considerations for pension plans and highlight the U.S. Commodity Futures Trading Commission’s report sounding alarms around climate’s systematic and economic risks to the financial system.

Economic Impacts of Climate Change

In this letter, we revisit the core thesis behind Redwood Grove’s strategy, sharing our research process of aligning fundamental and climate analyses to identify companies that can perform well in up and down cycles. We share why we joined investors managing close to a $1 trillion of assets to sign the Ceres letter, calling on the Federal Reserve to more actively incorporate climate change into its mandate of maintaining US market stability.

Ignoring Climate Change Risks Market Chaos

Woodwell Climate Research Center Executive Director Phil Duffy and Ted Roosevelt talk about the cost of ignoring scientific forecasts. A global pandemic like Covid-19 had long been forecasted by scientists, however the risks were largely ignored by the markets until the pandemic was on its doorstep. Climate change represents a similar kind of risk but on a longer and more expensive time scale. Unlike Covid-19, there is no vaccine for greenhouse gases.

2020, The Climate Decade

Entering 2020, Redwood Grove looks at climate change as a defining investment issue of the next decade. We highlight three key trends—declining low carbon technology costs, shifting public perception, and rising climate costs—that have reached tipping points, prompting major asset managers to recognize climate risks reshaping financial landscapes, with the potential for sustainable outperformance in climate-aware portfolios.

Three disruptive technologies in transportation that will meaningfully reduce emissions.

Redwood Grove explores the disruptions caused by electrification, shared mobility, and autonomous driving, highlighting companies such as Alphabet and General Motors as well-positioned for the shift. We outline our approach to portfolio construction, with a focus on investments in mitigation and adaptation strategies, as well as corporate leaders demonstrating awareness of the climate challenge.

Redwood Grove Capital’s Keynote Address at Climate Week NYC

Redwood Grove co-founder Ted Roosevelt presents at CFA Society of New York’s 2nd Annual Climate and ESG Owners Summit, discussing the vital intersection of climate science and investing. Ted shares his personal journey starting in research and trading, the realization of the inadequacy of backward-looking assumptions when accounting for the paradigm shift of climate change, and the urgent need for incorporating forward-looking scientific forecasts into investment models to make capital markets more climate aware.

Smart Cities and how the IoT will help increase resource efficiency

As a thematic, value-oriented public equity manager in the era of climate change, Redwood Grove outlines its dual investment process, emphasizing fundamental analysis and integrating the economic impacts of climate change. This letter shares our portfolio’s response to increased market volatility, and explores investment opportunities in smart cities and healthcare, particularly vaccinations, within the context of climate disruption.